Warren Buffett, a.k.a. the Oracle of Omaha, has long been a critic of the hedge fund industry. In 2005, his Berkshire-Hathaway shareholder letter included a challenge to the hedge fund industry in the form of a $500,000 wager, payable to the charity of the winner’s choice.

Buffett argued that over a period of ten years, $1 million invested in an unmanaged low cost index fund would generate greater returns than the average aggregate returns of five actively managed funds (hedge funds) selected by anyone willing to accept the bet.

Enter Ted Seides

Ted Seides is a cofounder of Protégé Partners, an enterprise that bills itself as, “Dedicated to sourcing, underwriting, and investing in the best in class talent amongst small and emerging managers.”

In short, Ted Seides believes himself eminently qualified to seek out the best hedge funds in which to invest. Utilizing these talents, he selected five funds of funds to compete with Buffett’s second, a Vanguard S&P index fund.

As They Enter the Stretch

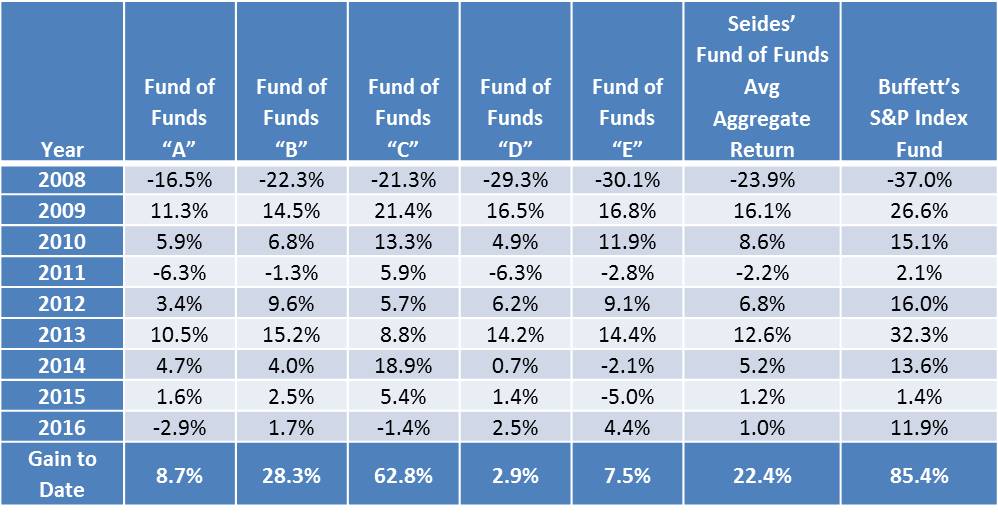

The table below illustrates the results through the first nine years of the wager:

It is clear to anyone that in seven of the nine years that have elapsed, Ted Seides’ choices have, taken together, endured a severe shellacking. However, one must also acknowledge that in the first year of the contest, even the weakest of Seides’ five picks outperformed the S&P index fund in mitigating losses.

Noteworthy, is the rather respectable performance of fund of funds “A” relative to the index fund in 2008, when it succeeded in thwarting $205,000 fewer dollars lost than did its index fund rival—a hedge fund’s core mission. Similarly, fund of funds “C” enjoyed a stellar, overall performance, although still falling short of the index fund’s gains.

What Will the Outcome of this Wager Prove?

The results will prove nothing. It is not purpose of hedge funds to outperform the S&P. Rather, the purpose of hedge fund investment is to preserve capital while, at the same time, offering opportunities for gain.

One could easily name five hedge funds that have, in the aggregate, outperformed the S&P index fund representing Mr. Buffett. This wager only proves that Mr. Seides failed to select those particular funds.

The bottom line is each investor has a goal. Hedge funds offer unique strategies that may, or may not, align with a particular investor’s goal. It is up to each investor to decide which investment strategy best aligns with their goal and invest accordingly.

The only thing this proves is that each party to the wager is capable of absorbing a $500,000 loss.

Not that I am taking side on this wager, you didn’t not name five hedge funds that over a period of ten years, previous nine at the present time, can beat $1 million invested in an low cost index fund.

You should put money where your mouth is, don’t you think?

To be fair, the funds of funds on the losing side of this wager were not named either.

“It is clear to anyone that in seven of the nine years that have elapsed, Ted Seides’ choices have, taken together, endured a severe shellacking. However, one must also acknowledge that in the first year of the contest, even the weakest of Seides’ five picks outperformed the S&P index fund in mitigating losses.”

In 2008, anyone would have bet against an unmanaged S&P index fund. The fact is that any prudent money manager would (and did) act to mitigate losses that year (2008). The proper comparison for 2008 is between hedge funds and other actively managed mutual funds or traditional equity accounts.