Institutional investors are swapping funds of funds for direct hedge fund investments.

Preqin surveyed 50 global investors from a wide range of institutions including public and private sector pension funds asset managers, insurance companies, banks, foundations, family offices and endowments, to gather information about their hedge fund portfolios and appetite for funds of hedge funds and single manager hedge funds.

The past two years have seen significant changes within the hedge fund industry. With institutional investors now constituting a considerable proportion of the investors in hedge funds they are shaping the industry as it emerges from the downturn with their demands for transparency, liquidity and better fee terms.

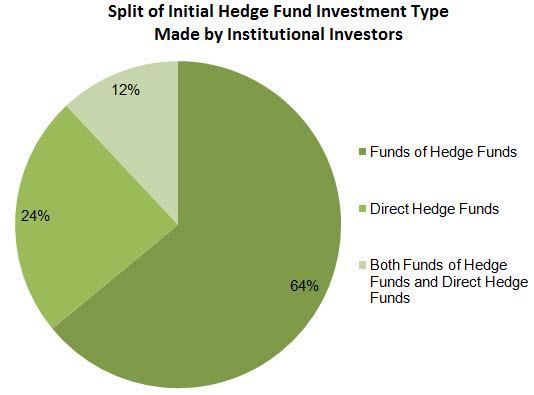

64 percent of all institutional investors make their first investments in the asset class through funds of funds. Funds of funds remain the vehicle of choice for institutional investors when they take their first footsteps in the asset class.

When new to hedge funds, investors do not have the experience or the necessary understanding to invest in an often confusing and opaque asset class.

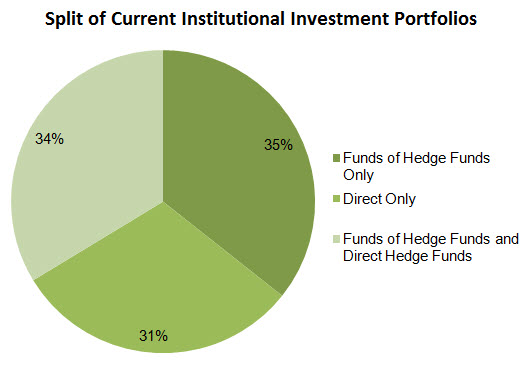

Not all investors move to a direct style of investment after years of investment in the asset class. Some institutions stick with funds of funds even as they gain more experience of investing in hedge funds. Respondents stated the diversification benefits of a multi-manager vehicle, a lack of resource or the use funds of funds to access niche strategies or regions as reasons why they remain active investors in funds of funds.

However, as a general trend, the Preqin hedge fund investor survey reveals that funds of funds become increasingly out of favor with institutional investors as they gain more experience of investing in the asset class. Today just 36 percent of all the surveyed investors still invest in hedge funds solely through multi-manager vehicles. The tipping point seems to be 2008 with 80 percent of the respondents which had moved away from a fund of funds style of investment having done so in the past two years.

A reduction in fees and greater control over their hedge fund portfolios were the two most commonly cited reasons why investors which had previously invested in funds of funds had moved into direct hedge fund investment.