The hedge fund industry has been through a time of great change since the market crisis and the institutional sector has become increasingly important to the industry since this time. In August 2010, Preqin released the findings of its latest institutional investor survey.

Preqin probed 50 institutional investors on their hedge fund plans for the next 12 months, intentions for the asset class over the longer term and general satisfaction with hedge funds returns.

Despite a slight drop in investor satisfaction in hedge fund returns over the past 12 months, institutional investors are beginning to invest more capital in hedge funds in greater numbers than they were a year ago. With 29% of institutional investors planning to allocate more capital to hedge funds in the next 12 months and just 15% looking to make cuts, the balance of inflows into the asset class is positive.

Despite a slight drop in investor satisfaction in hedge fund returns over the past 12 months, institutional investors are beginning to invest more capital in hedge funds in greater numbers than they were a year ago. With 29% of institutional investors planning to allocate more capital to hedge funds in the next 12 months and just 15% looking to make cuts, the balance of inflows into the asset class is positive.

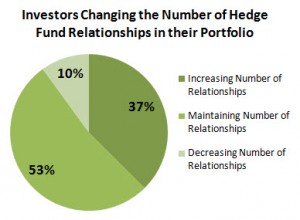

Furthermore, 37% of institutional investors are planning to add new funds to their portfolio in the next 12 months and are actively seeking relationships with new fund managers. Long/short equity and global macro funds look set to be the biggest winners of institutional mandates over the next 12 months with these being the strategies most commonly cited by the institutional respondents as the most attractive over the course of the next year.

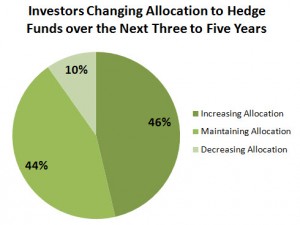

The long-term outlook for the asset class is even more positive, with 46% of investors planning to increase their exposure to hedge funds over the next three to five years.

exposure to hedge funds over the next three to five years.

It is clear that institutional investors still believe hedge fund investments are a valuable part of their portfolios. Recovery in terms of asset flows into the industry has already begun and the Preqin survey suggests it is likely to increase steadily over the medium to long term.

Preqin’s Investor Profiles products and services provide a comprehensive view of investors in alternative assets. They have profiles for over 4,500 investor institutions worldwide. Preqin analysts reach out to institutional investors from around the world to ensure our information is up to date. They also monitor news sources and regulatory filings to keep their resources current.