Data taken from the 2011 Preqin Global Hedge Fund Investor Review reveals that the difficult fund raising conditions of the past 2 years has fueled demand for seed capital injections that investors are increasingly keen to meet.

There has been a surge in the provision of seed capital from hedge fund investors over the past year. Since 2008 investors have mainly been shying away from seed deals as they waited for more stability to return to the asset class and the wider financial markets in general.

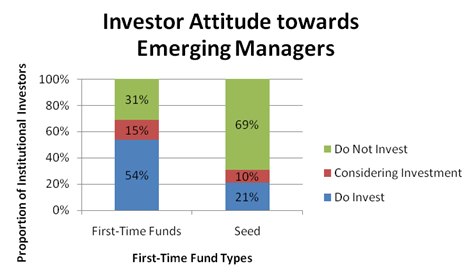

In 2009, just 11% of investors would provide seed capital to a fund and today this has nearly doubled to 21% of the institutional market. Many investors feel that there are numerous opportunities in the current environment for investment of this kind, and the benefits of fund ownership, fee negotiations and early access to the next generation of hedge funds outweigh the potential risk of such an investment.

In 2009, just 11% of investors would provide seed capital to a fund and today this has nearly doubled to 21% of the institutional market. Many investors feel that there are numerous opportunities in the current environment for investment of this kind, and the benefits of fund ownership, fee negotiations and early access to the next generation of hedge funds outweigh the potential risk of such an investment.

Seed arrangements are also beginning to evolve in this post-crisis era, with many investors not just providing seed capital to the youngest funds but also awarding seed capital to the more established vehicles, with years of track record under their belt. These funds which may have either stalled in their fund raising and need a capital injection to reach institutional size or have lost assets through the crisis have become attractive to some institutional investors.

Before the crisis, many fund managers were wary of entering seed arrangements that could see a loss of earning through fee-sharing arrangements with the investor, but in a more difficult fund raising climate many more funds are now seeking these kinds of capital injections. As a result the opportunities in the seeding market have rapidly grown in the past 12 months and there is a growing pool of institutional investors willing to provide the necessary capital for fund growth.

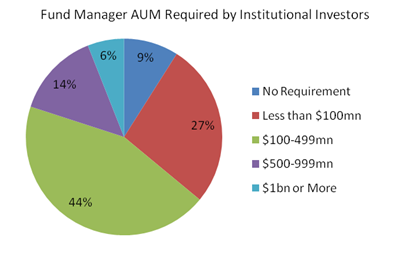

Other findings from 2011 Preqin Global Hedge Fund Investor Review reveal that investors are now considering investment in smaller funds. In 2009, a quarter of all investors would only consider funds with more than $500 million in assets. However this figure has fallen to 19% today. However investors are now setting higher barriers to entry in terms of track record. In 2009, half of all institutional investors would consider a fund with a track record of two years or less. Today this figure stands at 38% of institutional investors.