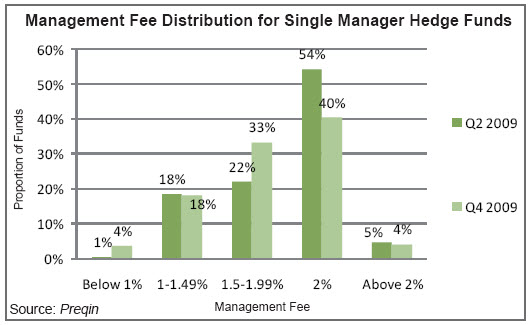

A recent study by Preqin reveals that hedge fund fees no longer fit with the “2 and 20” standard. They found that average management fee (for single manager funds) is 1.65 percent and the average performance fee is now below 19%.

Times have changed and, when starting a hedge fund, managers are setting fee structures lower than the traditional structure in order to earn back the attention of institutional investors after the markets melted down – along with returns.

Investors are now looking for fund managers to have more skin in the game. Some of the changes include revising the terms of the fund and lowering the fees – especially the management fee.

Before the market crisis, fees were often not challenged and investors paid higher fees in order to gain access to top performing managers. But times have changed. Institutional investors now find themselves with much stronger leverage and managers are showing new flexibility with their fees in order to attract capital.

Hedge fund managers still have a business to run. Many are providing various share classes with a lower fee structure but also include longer lock-up periods. These hedge fund managers are trading limited liquidity for a more stable base of capital and investors are seeing a reduced fee structure in return.

The study also revealed that the hedge funds with the highest performance incentives also generated the biggest returns for their investors. Investors will always be more interested in overall returns. Performance fees align with this objective an enable the fund manager to share in the upside.

Management fees, on the other hand, represent a cost to the investor and are disconnected from performance – a concept that will continue to put pressure on the 2 percent standard.