Sovereign Wealth Funds (SWFs) have continued to grow in size and status over the past year, and estimates are they represent $3.59 trillion in total assets under management (an 11% increase from 2009).

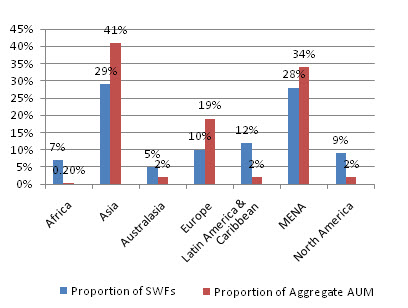

Asia and Middle East and North Africa (MENA) are home to the largest number of SWFs, representing 57% of all funds and 75% of the aggregate assets of SWFs.

Number and Value of Sovereign Wealth Funds by Region

The Sovereign Difference

In this difficult fund raising environment the backing of capital from unrestricted investors such as SWFs could be vital to the success of a fund.

Sovereign wealth funds are much different from other groups of institutional investors. Unlike pension funds these SWFs do not have liabilities to meet and are not subject to withdrawals from external investors (although some have been subject to government withdrawals over the past year). This leads to an investor with a considerably lengthy investment horizon and who are often free from scrutiny when investing in riskier alternative investments.

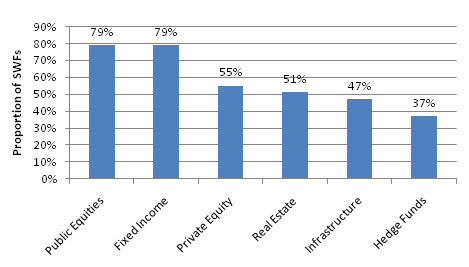

Proportion of Sovereign Wealth Funds Investing in Each Asset Class

The latest research shows that 37% of all SWFs invest in hedge funds with each allocating, on average, just over 8% of their assets to hedge funds. Hedge fund investment is a relatively new development within SWFs. Half of all the SWFs with an active interest in hedge funds have made their first investment in the asset class over the past 5 years.

SWFs tend to invest more heavily in other, less liquid, types of alternative assets such as private equity, real estate and infrastructure than they do in hedge funds. However as this trend for hedge fund investment begins to take hold of the SWF sector (particularly in an environment of increased demand for portfolio liquidity) then we can expect to see more funds committing to hedge fund managers and the amount of assets coming from these sovereign entities will grow.

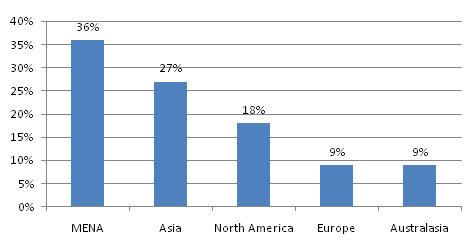

Expect growth in the use of hedge funds amongst the SWFs of Asia (which currently represent 27% of all the SWFs active in hedge funds). As the hedge fund industry begins to grow and mature in Asia, the SWFs will have more opportunity for investment in the asset managers based in their domestic region.

Regional Breakdown of Sovereign Wealth Funds Investing in Hedge Funds

Once such example is the China Investment Corporation. Established in 2007, China Investment Corporation (CIC) is one of the largest sovereign wealth funds in the world. CIC was created following a decision by the Chinese government to make better use of the country’s foreign reserves.

CIC made its first hedge fund investments in June 2009 and has since announced plans to continue making additional investments in the hedge fund space. It intends to build a hedge fund portfolio worth up to USD 6 billion and has expressed a preference for Asian-based hedge fund managers but will also invest globally and has committed to a number of US based hedge fund managers. It will invest in managed accounts, including direct hedge funds and fund of hedge funds and intends to target a range of strategies including distressed debt and credit.

Preqin recently launched the third edition of the Preqin Sovereign Wealth Fund Review. The 2010 Review represents an valuable tool for all professionals seeking investment or looking to work with this important investor class and includes information on all known sovereign wealth funds and detailed data on their investment activities in public equities, fixed income, private equity, real estate, infrastructure and hedge funds.